Everyone Wants to Be Rich! But Here’s Why I Pursue Being Wealthy Instead

First, let me outline the four primary ways that most people earn money:

- Path 1: Employee

- Path 2: Entrepreneur

- Path 3: Business Owner

- Path 4: Investor

In this article, I’ll explain the first three paths using a fun game I’ve just made up for this newsletter to illustrate my point called “Rich vs Wealthy.” Towards the end, I’ll share some tips that have helped me transition from one path to another.

Rich vs Wealthy:

Meet Eddie the Employee: Eddie earns $1 million in income and works 50 hours per week. Let’s assume Eddie has achieved a good work-life balance by working only 50 hours per week. The caveat: if Eddie doesn’t work, he doesn’t get paid.

Next, meet Bob the Entrepreneur: Bob’s business generates $3 million in revenue with $1 million in profit. He runs the daily operations with the support of a low-cost staff who need direction. If Bob is not around, his business struggles and profits decline. Essentially, he owns a job.

Now, meet Barbara the Business Owner: Barbara’s business also generates $3 million in revenue and $1 million in profit. However, she has systems and staff in place that run day-to-day operations autonomously. In fact, her business thrives even in her absence. She truly owns a business.

Drumroll, please… Who is richer?

It’s a trick question. All three of them are equally rich in the way society typically defines it because they each earn $1 million a year. However, the real question is who is wealthier and how they earn their money.

For context, let me provide my definitions of rich and wealthy:

Rich means making “a lot” amount of money, such as a rich doctor, rich parent, or rich uncle.

Wealthy means your income is not tied to your daily efforts and “a lot” of freedom.

So, between Eddie, Bob, and Barbara, who is wealthier?

Winner Winner: Barbara is the wealthiest as her income grants her freedom.

Rich vs Wealthy Round 2:

Now let’s elevate the discussion to private equity level. Here, the way money is earned and valued is different, often referred to as net worth or enterprise value.

- Eddie the Employee: $0 (he trades time for money; no one is purchasing other people’s jobs)

- Bob the Entrepreneur: His business would be valued at 1-3x profit (SDE – Seller’s Discretionary Earnings) since it is highly dependent on his time and efforts, equating to $1-3 million.

- Barbara the Business Owner: Her business would be valued at 5-10x profits (EBITDA – Earnings Before Interest, Taxes, Depreciation, and Amortization) since it doesn’t require her involvement, giving it a value of $5-10 million.

It’s important to recognize that “net worth” or business value can fluctuate over time. “You can’t pay your bills with net worth.” This is somewhat make believe until a deal is closed at that value.

On the other hand, profit increases are more tangible for most people.

Now, let’s say that over one year, the profits of their ventures increase to $2 million. How would this affect their net worth?

- Eddie: $0 (kudos to Eddie for his earnings, but 0 x anything is still 0)

- Bob’s Business: Now valued between $2-6 million

- Barbara’s Business: Now valued between $10-20 million

As you can see, there is an exponential difference in value output.

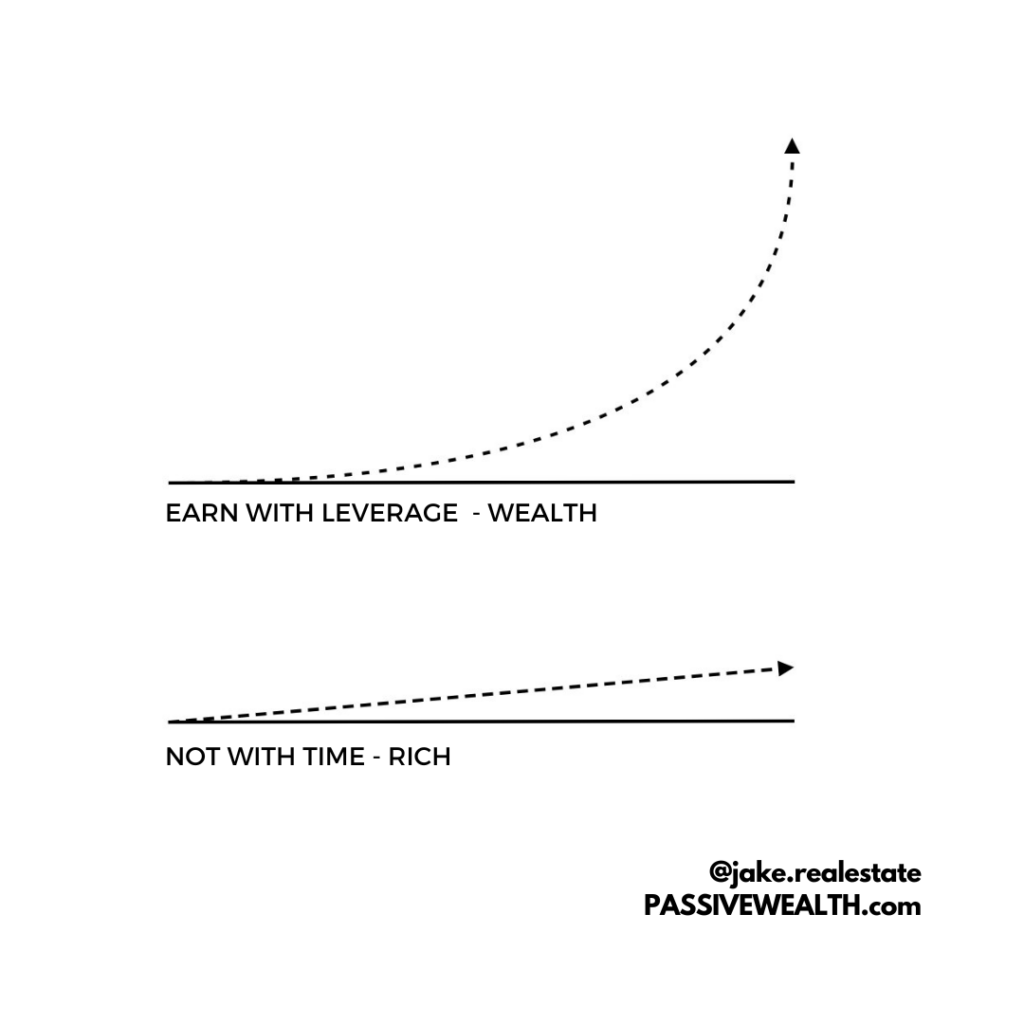

What’s the difference? Leverage.

As Naval Ravikant aptly puts it:

“Forget rich versus poor, white-collar versus blue. It’s now leveraged versus un-leveraged.”

For most of my life, I have been in Eddie and then Bob’s paths. If you are already on Barbara’s path, congratulations! You now have the potential to unlock the 4th Path of Income:

Investor Path. I will delve into the details of this path and leverage in a future edition of the newsletter.

But if you’re aspiring to be more like Barbara, here are five strategies that have helped me transition between paths and could potentially expedite your journey

- Develop a Side Hustle (Employee Tip): Break free from solely earning money for someone else. If you’re earning a high income, you have value. Seek equity or commission-based opportunities. If that’s not feasible, start a side hustle. For instance, create a newsletter or blog about something you’re passionate about (maybe it’s flyfishing), develop a course around a common problem, and sell it. Sell it for $100-200. By doing this, your content begins to draw attention to your product. Selling 50 courses a month could net you an extra $10,000 monthly.

- Entrepreneur Tip: The biggest issue is all the business requires your efforts. Owning a job is often times way more stressful than just having a job. I have yet to meet a business owner that hasn’t had thoughts of burning down their own company to just quit. Myself included. Business is hard especially if you’re doing the things you suck at or hate.Hire for the Suck: Throughout most of my business career, I was somewhat of a control freak and struggled with delegating tasks. Part of the reason was that I didn’t hire the right people; I tended to employ generalists instead of specialists, often hiring individuals whose skills mirrored my own. My business suffered because I had to take on tasks that I didn’t enjoy and that drained my energy. However, I learned that some people actually love doing the things I loathe. If you hire someone who relishes tasks you dislike, it will free up your time to focus on what you enjoy and are good at.

- Community Building (Employee & Business tip:): (Hint: this is the direction in which I am taking this newsletter.) Concentrate on building a robust community around your brand. This not only aids in customer retention but also turns your customers into brand ambassadors.The final two are also big ahas for me as they tap into that leverage factor. You need to be able to start thinking 10x and 100x. So that all your efforts focus in the things that give you 10-100x returns on your time.

- Automation Tools: Entrepreneurs & Employees often overlook the importance of investing in automation tools such as CRM systems, email marketing platforms, or social media schedulers for managing recurring tasks efficiently. Investing in automation was a game-changer for me. Leveraging software and AI can sometimes replace entire roles at a fraction of the cost, and with greater reliability.

- Outsourcing: If you haven’t yet employed offshore staff, you’re missing out. Exceptionally skilled staff members are available at rates ranging from $3-8 per hour. Outsource non-core functions such as customer support, cold calling, data scraping, marketing, and sales development. This enables you to concentrate on the main aspects of your business.

I’d love to hear from you to know if the “Rich vs. Wealthy” game was insightful and was able provided some context on the importance of playing the right game. Also sheds light on why I am embarking on a pursuit of wealth and not being rich.